AI in Accounts Payable: Before and After Real Stories from Finance Teams

Finance teams face constant pressure to improve their efficiency, reduce errors and gain better visibility into their accounts payable (AP) processes. Learning from real-world examples of organisations that have implemented AI in accounts payable offers valuable insights into the tangible improvements and strategic benefits possible. Finance teams have achieved significant transformation in their AP workflows through AI, with specific Snowfox customer case studies highlighting the tangible before and after improvements.

The Challenge: Manual AP Processes Before AI

Before adopting AI, many finance teams struggled with time-consuming, error-prone manual AP processes. Data entry was often completed by hand, increasing the risk of mistakes and slowing down invoice processing. Teams faced bottlenecks in routing and approvals, leading to delayed payments and strained supplier relationships. Lack of real-time visibility made it difficult for CFOs and finance leaders to monitor cash flow or identify compliance risks promptly.

Hartela (a Finnish construction company) experienced these common pain points. Their AP team spent significant time manually coding and routing invoices, which limited scalability and increased operational costs. Similarly, Cramo (a leading equipment rental company) faced challenges with manual routing that consumed valuable staff hours and introduced inefficiencies.

These issues are typical across many organisations relying on legacy or manual AP workflows. They dramatically reduce productivity and limit the finance team’s ability to focus on strategic priorities.

The Transformation: How AI Changed AP Workflows

AI-driven automation reshapes AP by automating invoice capture, coding, routing and approvals with high accuracy and speed. Snowfox’s AI platform uses predictive coding models trained on historic invoice data to reduce manual effort and errors. Invoices are automatically routed through approval workflows, accelerating processing times and improving compliance.

Hartela saw rapid improvements, achieving 90% accuracy in automated coding within months of implementation. This freed their team from repetitive tasks and enabled them to handle higher invoice volumes without increasing headcount. Cramo reduced manual routing time by a staggering 95%, streamlining approvals and accelerating payment cycles.

These transformations demonstrate how AI in accounts payable can deliver measurable efficiency gains, reduce operational burden and provide finance leaders with real-time visibility into their AP processes.

Case Study Highlight – Hartela

Hartela’s journey to AI-powered AP automation began with a clear need to improve accuracy and scalability. Before Snowfox, manual coding and routing slowed their AP team and increased error rates. After implementing Snowfox AI, they quickly reached 90% predictive coding accuracy, drastically reducing manual intervention. This allowed Hartela to process invoices faster and with greater confidence, supporting their growth ambitions without the need for more staff. The AI system adapted to their existing processes, ensuring a smooth transition and immediate benefits.

Case Study Highlight – Cramo

Cramo’s experience highlights the impact of AI on manual routing challenges. Prior to Snowfox, their AP team spent excessive time routing invoices manually, creating bottlenecks and delaying approvals. Snowfox’s AI automation cut manual routing time by 95%, enabling invoices to flow seamlessly through approval chains. This not only saved time but also improved compliance and auditability. Cramo’s finance team could focus on exceptions and strategic tasks, enhancing overall operational efficiency and company growth.

The Outcomes: Business Impact and Strategic Benefits

Post-implementation, finance teams report significant time savings, cost reductions and improved compliance. Automated invoice processing reduces manual errors and accelerates payment cycles, improving supplier relationships and cash flow management. Real-time analytics provide CFOs with enhanced visibility into spend patterns and process bottlenecks.

Hartela and Cramo’s results exemplify these benefits. Hartela’s improved accuracy and efficiency supported their ability to scale without increasing AP headcount. Cramo’s streamlined routing cut processing times dramatically, reducing operational costs and improving audit trails.

These outcomes demonstrate that AI in accounts payable is not just a technology upgrade but a strategic enabler that transforms finance operations, delivering measurable ROI and freeing teams to focus on higher-value activities.

Lessons Learned: Tips for Finance Teams Considering AI

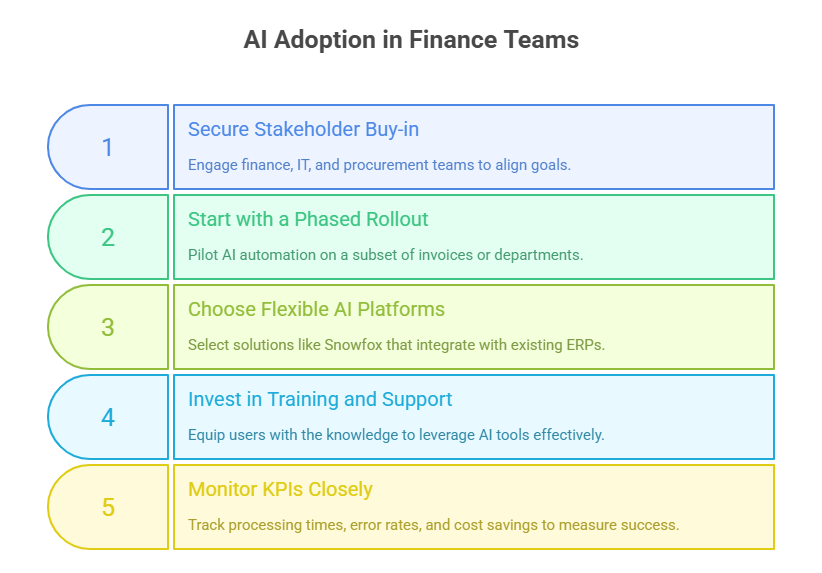

Drawing on these case studies, several practical lessons emerge for finance teams planning AI adoption:

- Secure stakeholder buy-in early: Engage finance, IT and procurement teams to align goals and ensure smooth change management.

- Start with a phased rollout: Pilot AI automation on a subset of invoices or departments to build confidence and refine workflows.

- Choose flexible, integratable AI platforms: Solutions like Snowfox that connect seamlessly with existing ERPs reduce disruption and accelerate time to value.

- Invest in training and support: Equip users with the knowledge to leverage AI tools effectively and handle exceptions confidently.

- Monitor KPIs closely: Track processing times, error rates and cost savings to measure success and identify optimisation opportunities.

These steps help finance teams overcome common implementation challenges and maximise the benefits of AI in accounts payable.

Real Change Starts with Real Stories

The experiences of Hartela, Cramo and other Snowfox customers prove that AI in accounts payable is a proven game-changer. These real stories show how finance teams can move from manual, error-prone processes to streamlined, accurate and scalable workflows. The strategic benefits extend beyond efficiency gains to improved compliance, better cash flow management and enhanced finance leadership.

For CFOs and finance leaders, exploring AI automation with Snowfox offers a clear path to transforming AP operations. The combination of advanced AI technology and dedicated implementation support ensures a low-disruption transition with rapid, measurable results.To see how AI can transform your accounts payable and deliver similar business impact, contact us today to book your AI readiness consultation.