Accounts payable (AP) is a critical function in any finance operation, yet it often remains burdened by manual tasks, errors and inefficiencies. For CFOs, implementing AI in accounts payable workflows offers a strategic opportunity to transform these processes, unlocking time savings, accuracy and scalability. Finance leaders need to understand the essential considerations, challenges and benefits of adopting AI-driven AP automation to lead successful implementations that deliver measurable business value.

Why AI is a Game-Changer for AP Workflows

AI fundamentally reshapes accounts payable by automating repetitive tasks such as invoice capture, coding, routing and approvals. Instead of relying on manual data entry and paper-based processes, AI-powered systems extract invoice data with high accuracy, predict coding based on historical patterns and route invoices through approval processes automatically. This reduces processing times dramatically while minimising human error.

Beyond speed and accuracy, AI enhances compliance by enforcing consistent controls and audit trails. It also provides real-time visibility into invoice status and spend data, enabling CFOs to make more informed decisions. By automating routine work, finance teams can focus on exceptions and strategic activities, improving overall operational efficiency and agility.

Key Considerations for CFOs Before Implementing AI in Accounts Payable

Successful AI adoption in AP requires careful planning across several dimensions. CFOs should evaluate integration capabilities, data security, scalability and change management to ensure the solution fits their organisation’s needs and environment.

Integration with Existing Systems

Seamless integration with ERP and accounting software is vital. AI platforms like Snowfox use APIs and connectors to synchronise data bi-directionally, avoiding silos and manual reconciliation. This ensures end-to-end automation from invoice receipt to payment, preserving data integrity and workflow continuity.

Ensuring Data Security and Compliance

Financial data is highly sensitive, so robust security measures are non-negotiable. Encryption, role-based access controls and regular compliance audits protect against breaches and regulatory risks. CFOs must verify that AI vendors adhere to industry standards and data protection regulations.

Scalability for Future Growth

AI solutions scale effortlessly as invoice volumes grow or workflows become more complex. Cloud-based architectures offer flexibility to add users, features or locations without disruption. Choosing a scalable platform future-proofs the investment and supports evolving business requirements.

Overcoming Common Implementation Challenges

Implementing AI in AP is not without hurdles. Resistance to change among staff can slow adoption, making clear communication and training essential. Legacy ERP systems may require custom integration work or workarounds to connect smoothly with AI tools. Additionally, insufficient internal IT resources can delay deployment.

Partnering with an experienced vendor who provides dedicated implementation support and user onboarding helps mitigate these challenges. Starting with a pilot phase allows teams to build confidence and refine processes before full rollout.

How Snowfox Supports CFOs in AI AP Implementation

Snowfox’s AI-driven accounts payable automation is designed with CFO priorities in mind. Its predictive coding engine learns from historic invoice data to automate coding with high accuracy, reducing manual effort and errors. Snowfox integrates plug-and-play with major ERPs including SAP, Oracle and Microsoft Dynamics, using APIs to ensure seamless data flow without the need for complex IT projects.

The platform’s cloud-based architecture scales easily to handle growing invoice volumes and complex approval workflows. Snowfox also provides real-time analytics and reporting, giving CFOs visibility into process performance and spend insights. Implementation managers guide clients through a typical 2–4 week onboarding, minimising IT disruption and accelerating time to value.

By combining advanced AI with practical integration and support, Snowfox empowers finance leaders to transform AP into a strategic, efficient function.

Measuring Success: KPIs to Track Post-Implementation

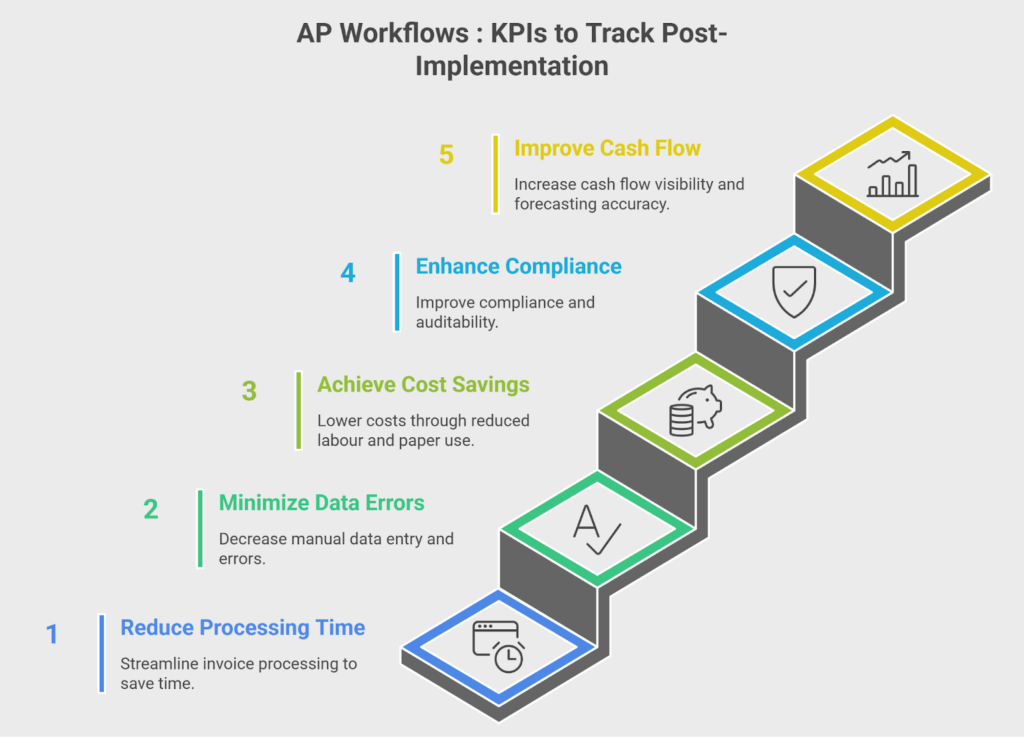

To evaluate the impact of AI, CFOs should monitor key performance indicators such as:

Tracking these metrics helps demonstrate ROI and identify further optimisation opportunities.

Empowering Finance Leadership with AI in Accounts Payable

AI in accounts payable is a strategic enabler that frees finance teams from manual work, improves accuracy and delivers scalable efficiency. For CFOs, understanding integration, security and change management is key to successful implementation. Snowfox’s AI-powered automation offers a proven, low-disruption path to transform AP workflows and unlock measurable business value.To explore how AI can elevate your accounts payable function, book an AI readiness consultation with Snowfox today. Reach out via our contact page to take the next step towards smarter, faster finance operations.